economy since the start of the Great Recession, The People’s Budget provides an upfront economic stimulus large enough to close estimated output gaps-a measure of how far from potential the economy is operating-as well as restore employment-to-population ratios for prime-age workers to pre–Great Recession levels. To unambiguously close the persistent jobs gap that has plagued the U.S.

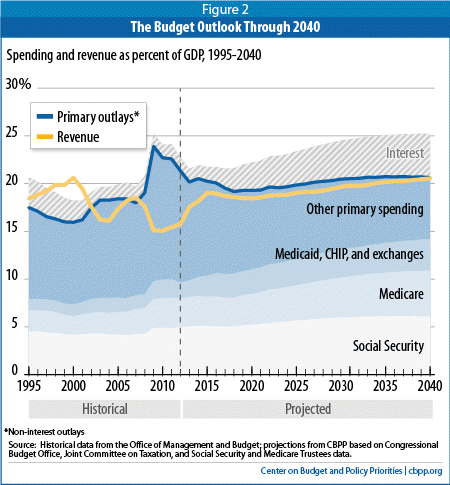

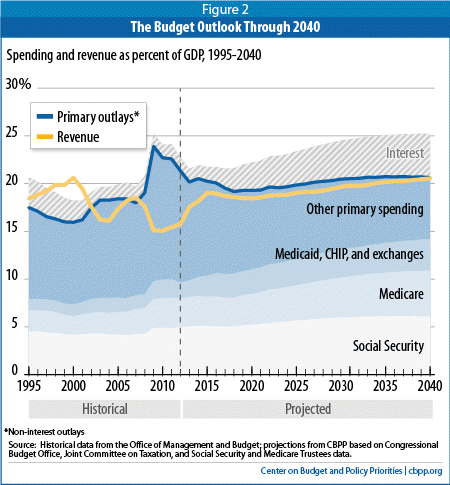

Improve the economic well-being of low- and middle-income families by f inally completing and locking in the economic recovery. We find that The People’s Budget would have significant, positive impacts. Tables 1 and 2, which detail the policy changes within the budget, and Summary Tables 1–4, which depict budget totals as well as comparisons with the current law baseline, appear at the end of the report. 1įigures A–C-which show the impact of The People’s Budget on debt, deficits, and nondefense discretionary funding compared with current law, the president’s budget, and historical averages-appear in the body of the report. This paper details the budget baseline assumptions, policy changes, and budgetary modeling used in developing and scoring The People’s Budget, and it analyzes the budget’s cumulative fiscal and economic impacts, notably its near-term impacts on economic recovery and employment. It builds on recent CPC budget alternatives in setting the following priorities: near-term job creation, financing public investments, strengthening low- and middle-income families’ economic security, raising adequate revenue to meet budgetary needs while restoring fairness to the tax code, strengthening social insurance programs, and ensuring long-run fiscal sustainability. The report also illustrates trends in federal mandates considered by the Congress since the enactment of the 1995 law.The Congressional Progressive Caucus (CPC) has unveiled its fiscal year 2019 (FY2019) budget, titled The People’s Budget: A Progressive Path Forward. The report identifies which legislation before the Congress would have imposed federal mandates on another level of government or the private sector. This annual report summarizes CBO's activities under Title I of UMRA during a given calendar year and updates data provided in the agency's previous reports on that law.

Improve the economic well-being of low- and middle-income families by f inally completing and locking in the economic recovery. We find that The People’s Budget would have significant, positive impacts. Tables 1 and 2, which detail the policy changes within the budget, and Summary Tables 1–4, which depict budget totals as well as comparisons with the current law baseline, appear at the end of the report. 1įigures A–C-which show the impact of The People’s Budget on debt, deficits, and nondefense discretionary funding compared with current law, the president’s budget, and historical averages-appear in the body of the report. This paper details the budget baseline assumptions, policy changes, and budgetary modeling used in developing and scoring The People’s Budget, and it analyzes the budget’s cumulative fiscal and economic impacts, notably its near-term impacts on economic recovery and employment. It builds on recent CPC budget alternatives in setting the following priorities: near-term job creation, financing public investments, strengthening low- and middle-income families’ economic security, raising adequate revenue to meet budgetary needs while restoring fairness to the tax code, strengthening social insurance programs, and ensuring long-run fiscal sustainability. The report also illustrates trends in federal mandates considered by the Congress since the enactment of the 1995 law.The Congressional Progressive Caucus (CPC) has unveiled its fiscal year 2019 (FY2019) budget, titled The People’s Budget: A Progressive Path Forward. The report identifies which legislation before the Congress would have imposed federal mandates on another level of government or the private sector. This annual report summarizes CBO's activities under Title I of UMRA during a given calendar year and updates data provided in the agency's previous reports on that law.

As required by the Unfunded Mandates Reform Act of 1995, CBO includes in cost estimates an assessment of whether legislation contains federal mandates and provides an estimate of the costs imposed by those mandates on state, local, and tribal governments and the private sector. CBO's cost estimates and scorekeeping system show how individual legislative proposals would change spending or revenue levels under current law and help to determine whether those budget effects are consistent with the targets in the Congress's most recent budget resolution. (For proposals that would amend the Internal Revenue Code, CBO is required by law to use estimates provided by the Joint Committee on Taxation.) It prepares cost estimates of pending legislation and tracks the progress of such legislation in a scorekeeping system. To assist the Budget Committees and the Congress with enforcement of the budget resolution, CBO analyzes the spending or revenue effects of specific legislative proposals. The agency began operating on February 24, 1975, with the appointment of Alice Rivlin as the first director. The CBO was founded on July 12, 1974, with the enactment of the Congressional Budget and Impoundment Control Act (P.L. The Congressional Budget Office (CBO) is a non-partisan department in Congress which assesses the financial impact of legislation.

0 kommentar(er)

0 kommentar(er)